The world of cryptocurrency is a whirlwind of innovation and volatility. Bitcoin headlines dominate the news, Ethereum fuels an entire ecosystem of decentralized applications, and new tokens emerge with dizzying speed. This rapid evolution can leave even seasoned investors unsure where to begin.

The world of cryptocurrency is a whirlwind of innovation and volatility. Bitcoin headlines dominate the news, Ethereum fuels an entire ecosystem of decentralized applications, and new tokens emerge with dizzying speed. This rapid evolution can leave even seasoned investors unsure where to begin.

How do you invest in digital currencies without getting lost in the hype? In this comprehensive guide, we break down what cryptocurrencies are, explain the foundational blockchain technology, examine the critical differences between Bitcoin and Ethereum, and provide key principles for building a strategic crypto allocation. Whether you’re a curious beginner or an experienced trader looking for clarity, you’ll find practical insights for navigating the ever-evolving landscape of digital assets.

Part 1: The Foundation – Understanding Crypto and Blockchain

What are Cryptocurrencies? (The “Digital Ledger” Analogy)

A cryptocurrency is a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit or double-spend. Unlike traditional fiat money issued by central authorities, cryptocurrencies exist on decentralized networks powered by blockchain technology.

Think of a blockchain as a public, distributed digital ledger. Imagine a Google Sheet that is duplicated across a vast network of computers. This network is designed to regularly update this spreadsheet with new, cryptographically verified transactions. Each update is locked into the previous one, creating a permanent, unchangeable chain. This structure allows for peer-to-peer payments without intermediaries and enables programmable features via smart contracts—self-executing code that runs on the blockchain.

Categories of Cryptocurrency: More Than Just Money

Cryptocurrencies serve many purposes. Understanding a token’s category is key to evaluating its potential and risk.

Transactional Tokens: Designed as digital cash (e.g., Bitcoin (BTC)).

Platform Tokens: Power blockchain ecosystems and decentralized applications (dApps) (e.g., Ethereum (ETH), Solana (SOL)).

Utility Tokens: Provide access to services or functions on a specific blockchain.

Governance Tokens: Grant holders voting rights in decentralized networks (e.g., Uniswap’s UNI).

Stablecoins: Pegged to stable assets like the U.S. dollar to reduce volatility (e.g., USDC, USDT).

Security Tokens: Represent ownership in real-world assets like stocks or property.

A coin with real utility is generally less speculative than a meme coin with no underlying use case.

The Pros and Cons of Crypto Investing

Pros:

Potential for Growth: As a nascent asset class, it offers significant capital gains potential.

Decentralization: Operates on a global peer-to-peer network, reducing reliance on traditional financial intermediaries.

Portfolio Diversification: Has historically exhibited low correlation to traditional assets like stocks and bonds.

Innovation: Provides exposure to groundbreaking technology reshaping finance, art, and digital ownership.

Cons:

Extreme Volatility: Prices can swing dramatically in short periods.

Regulatory Uncertainty: Government rules are still evolving and could impact value and legality.

Security Risks: Individuals are targets for hacks, phishing scams, and user error (e.g., losing private keys).

Technological Risk: Smart contracts can have bugs, and new technologies can disrupt older ones.

Part 2: The Major Players – Bitcoin, Ethereum, and The Altcoin Universe

Here’s a high-level overview of the core components of the crypto ecosystem.

| Category | Key Examples | Primary Function | Risk Profile |

|---|---|---|---|

| Store of Value | Bitcoin (BTC) | Digital Gold / Peer-to-Peer Electronic Cash | High |

| Smart Contract Platform | Ethereum (ETH) | Foundation for dApps, DeFi, and NFTs | Very High |

| Stablecoins | Tether (USDT), USD Coin (USDC) | Price-Stable Digital Dollars | Low to Medium |

| Altcoins & DeFi Tokens | Solana (SOL), Uniswap (UNI) | Compete with Ethereum or Power Financial dApps | Very High |

| Meme Coins | Dogecoin (DOGE) | Community-Driven, Speculative | Extreme |

Bitcoin (BTC): The Digital Gold Standard

Bitcoin (BTC): The Digital Gold Standard

The Pioneer. It was created by the pseudonymous Satoshi Nakamoto. Bitcoin was designed as a peer-to-peer electronic cash system. Its value proposition has solidified as a decentralized store of value and a hedge against inflation.

Key Characteristics:

Scarcity: Supply is capped at 21 million coins.

Security: Uses a energy-intensive Proof-of-Work (PoW) consensus mechanism, which has proven highly secure.

Decentralization: Its distributed nature reduces the risk of censorship or manipulation.

As noted by CoinDesk, Bitcoin’s narrative has evolved into that of a macroeconomic asset, often compared to gold.

Ethereum (ETH): The Programmable World Computer

The Digital Economy. Ethereum is a decentralized software platform that enables developers to build and deploy smart contracts and decentralized applications (dApps).

Key Characteristics:

Programmability: Its smart contracts power everything from DeFi to NFTs.

The Merge: In 2022, Ethereum transitioned from PoW to a more efficient Proof-of-Stake (PoS) consensus, slashing energy consumption by ~99.9%.

Flexible Supply: Its supply adjusts dynamically; a portion of transaction fees is burned, creating deflationary pressure.

According to a report by The Block, Ethereum’s dominance in the developer community makes it a critical barometer for the health of the broader crypto market.

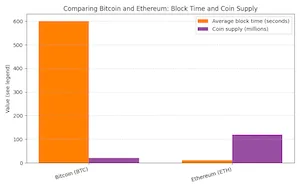

Comparing Bitcoin and Ethereum

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Primary Use | Store of Value, Digital Gold | Programmable Platform, Digital Economy |

| Consensus | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

| Block Time | ~10 minutes | ~12 seconds |

| Supply | Capped at 21 million | Dynamic, deflationary mechanism |

| Energy Use | High | Low post-Merge |

The “Altcoins”: Exploring Alternative Cryptocurrencies

This vast category includes everything from established projects to speculative tokens.

Platform Coins: Competitors like Solana (SOL) and Cardano (ADA) aim for higher speed or different governance.

DeFi Tokens: Protocols like Uniswap (UNI) and Aave (AAVE) power decentralized financial applications.

Privacy Coins: Enhance anonymity by concealing transaction details.

A study by CoinGecko on altcoin season cycles highlights the extreme volatility and rotational nature of this market segment.

Part 3: How to Invest in Cryptocurrency – A Strategic Approach

Principles for Investing in Crypto

The first rule is to never invest more than you can afford to lose. Experts often recommend that crypto allocations comprise no more than 5% of your overall portfolio.

Other core principles include:

Dollar-Cost Averaging (DCA): Make small, recurring purchases on a set schedule to reduce the impact of volatility.

Research & Security: Focus on projects with real utility and experienced teams. Store holdings securely in hardware wallets.

Objectivity & Discipline: Avoid emotional decision-making and stick to a predetermined strategy.

Building a Balanced Crypto Portfolio

For investors comfortable with the risks, a small crypto allocation can complement traditional assets. Here’s an example of how to structure a 5% crypto sleeve within a diversified portfolio:

2% Bitcoin (BTC): Long-term store of value and most liquid cryptocurrency.

1% Ethereum (ETH): Exposure to the leading smart-contract platform.

1% Major Altcoins: Select a few high-quality projects with strong fundamentals (e.g., Solana, Cardano).

1% Stablecoins/Cash: Hold USDC or DAI for liquidity and yield opportunities (e.g., lending).

This allocation provides exposure to the biggest networks while capping downside risk.

Choosing a Cryptocurrency Exchange and Wallet

Centralized Exchanges (CEXs): Platforms like Coinbase and Kraken are user-friendly for beginners.

Decentralized Exchanges (DEXs): Protocols like Uniswap allow peer-to-peer trading without an intermediary.

The Golden Rule: Not Your Keys, Not Your Crypto. For significant holdings, transfer crypto off an exchange into a self-custody wallet:

Hardware Wallets (e.g., Ledger): “Cold storage,” most secure.

Software Wallets (e.g., MetaMask): “Hot” wallets, convenient for frequent use.

Part 4: Navigating the Risks and Future of Crypto

The Future Outlook: Web3, Regulation, and Adoption

The Future Outlook: Web3, Regulation, and Adoption

Several trends could shape the future of digital assets:

Institutional Adoption: Large financial institutions and corporations are exploring digital assets, lending legitimacy.

Regulation: Governments worldwide are crafting rules. Transparent regulation could encourage adoption, but heavy restrictions might stifle innovation.

Technology Advancements: Scalability solutions like layer-2 networks (e.g., Arbitrum) aim to reduce congestion and fees.

DeFi and Web3: These ecosystems promise to recreate financial services and a user-controlled internet, though they remain experimental.

Environmental Considerations: Ethereum’s PoS transition addresses energy concerns, a major criticism of the sector.

A comprehensive analysis by The Harvard Business Review on Web3 suggests that while the technology is promising, it remains in its early, experimental stages.

Conclusion: Investing with Knowledge and Caution

Cryptocurrency investing is a journey into a new technological paradigm. Bitcoin offers scarcity and security as digital gold. Ethereum opens the door to a programmable digital economy. Altcoins introduce specialized use cases but demand thorough research.

A prudent approach is essential. Start with the giants, deepen your knowledge gradually, and always prioritize security. By combining education with a disciplined, long-term strategy centered on dollar-cost averaging and intelligent portfolio allocation, you can better navigate the volatility and potentially capture the opportunities this new asset class offers.

References:

CoinDesk. “What Is Bitcoin?” CoinDesk Learn.

The Block. “Ethereum’s Merge: What You Need to Know.” The Block Research.

CoinGecko. Alt-Season Is Back: All You Need to Know

Kraken. What are stablecoins? Types, benefits and risks explained

Harvard Business Review. “Web3 Will Run on Crypto. Can It Be Regulated?”

Ledger Academy. Not Your Keys, Not Your Coins: Explained